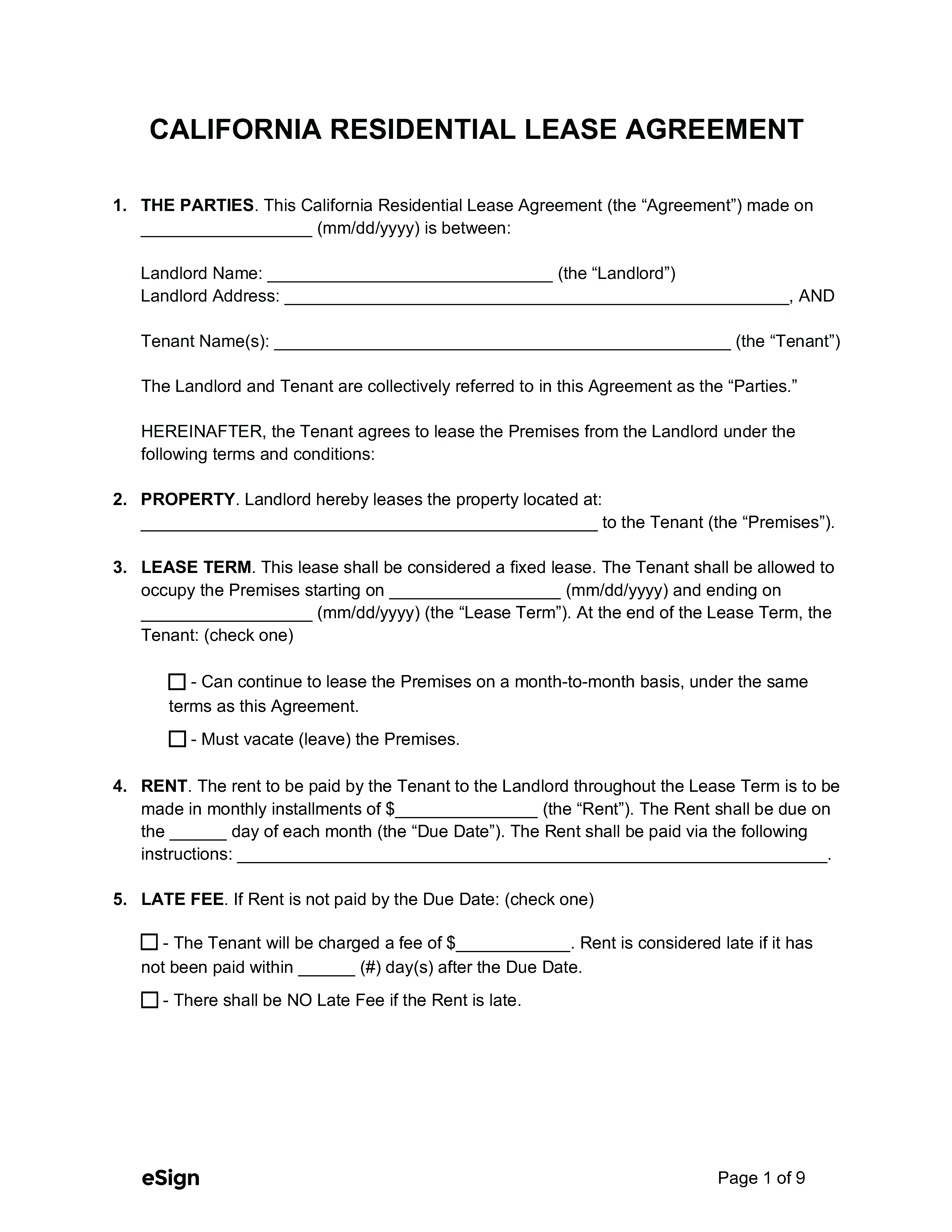

A California lease agreement is a contract between a landlord and tenant for the renting of real estate. It’s written after both parties have discussed the monthly payment and other rental terms, including the lease duration, utilities, late fees, and pet policy. Upon signing, the tenant is commonly required to pay the first month’s rent, security deposit, and any other fees.

A California lease agreement is a contract between a landlord and tenant for the renting of real estate. It’s written after both parties have discussed the monthly payment and other rental terms, including the lease duration, utilities, late fees, and pet policy. Upon signing, the tenant is commonly required to pay the first month’s rent, security deposit, and any other fees.

PDF Download

A California lease agreement is a contract between a landlord and tenant for the renting of real estate. It’s written after both parties have discussed the monthly payment and other rental terms, including the lease duration, utilities, late fees, and pet policy. Upon signing, the tenant is commonly required to pay the first month’s rent, security deposit, and any other fees.

4.7 | 426 Ratings Downloads: 116,349

Rental Application – This form is used to examine each lease applicant’s background before choosing an individual for tenancy.

Maximum Amount ($) – Two months’ rent if the unit is unfurnished and three months’ rent if it is furnished. [16]

Collecting Interest – California doesn’t require landlords to pay interest on security deposits, but several rent-controlled cities within the state do. Landlords in rent-controlled cities should check local housing laws for specific interest rates.

Returning to Tenant – The landlord must return a security deposit no later than 21 days after the tenant has vacated the premises. [17]

Itemized List Required? – Yes, an itemized statement outlining the amount and reason for each deduction must be provided to the tenant when their deposit is refunded. [18]

Separate Bank Account? – No, there are no state statutes that require landlords to store security deposits in separate bank accounts.

General Access – Landlords must provide reasonable notice before entering the rental unit. According to state law, 24 hours’ notice is considered reasonable. [19]

Immediate Access – A landlord may enter a tenant’s dwelling without notice for emergency purposes. [20]

Grace Period – Unless agreed to in the lease, landlords are not obligated to provide a grace period.

Maximum Late Fee ($) – Not mentioned in state statutes, but late fees should not exceed the reasonable estimate of costs the landlord will incur due to the late rent payment. [21]

Bad Check (NSF) Fee – Landlords can charge a maximum fee of $25 for the first bounced check and $35 for each subsequent one. [22]

Withholding Rent – If the landlord doesn’t keep the property in a livable condition and doesn’t fix the issue within a reasonable timeframe after being notified, the tenant can deduct up to one month’s rent to cover the repair costs. [23] Tenants can also stop paying rent altogether if the landlord doesn’t fix a serious defect that endangers their health and safety. [24]

Non-Payment of Rent – Landlords can provide a 3-day notice if a tenant’s rent is late. [25]

Tenant Maintenance – Tenants have a legal obligation to maintain the rental unit. If they substantially ignore this responsibility, they’ll be liable for the necessary repairs. [27]

Lockouts – Landlords cannot change the locks to prevent tenants from entering the rental unit. [28]

Leaving Before the End Date – If rent is over 14 days late and the landlord believes that the property has been abandoned, the tenant will be responsible for the unpaid balance, and the lease will terminate automatically. [29]

Month-to-Month Tenancy – Landlords can use a 30-day notice to terminate a monthly tenancy that’s lasted less than a year, or a 60-day notice if the tenancy has been in effect for one year or longer. [30]

Unclaimed Property – Landlords must provide a notice instructing tenants to retrieve their belongings within 15 days if the notice is hand-delivered or 18 days if it’s sent by mail. [31] Any property left unclaimed will be sold at a public auction. However, the landlord can dispose of or keep the property if the total worth of the tenant’s possessions is under $700. [32]